Students know that I am a fan of Professor Aswath Domadaran. In class, I call him "The Lionel Messi of Finance". But it turns out that he calls himself "The Kim Kardashian of Valuation"! That's because, as he tells Barry Ritholz in the podcast below, he "shows everything". This is of course a reference to the tonnes of material that he publishes online. You can see some of the relevant links to the right. Anyway, here are some recent ideas from the man himself. Enjoy!

[1] Apple valuation. Prof. Damodaran calls Apple [Nasdaq: AAPL] the "Greatest Cash Machine in History" [see his detailed post]. (I remember that we used to say the same thing about Google a few years ago). In his Free Cash Flow to the Firm (FCFF) valuation, he arrives at a value per share of $129.02. As the market closed yesterday at $135.35, the shares are "fullly valued", although he will wait for a price of $140 before selling his position. Well done! In class at EU Business School, I use Apple as an example of how a company can successfully 'declare war on its WACC'. The Cupertino giant does that by outsourcing its production (lower beta), by turning the iPhone into a non-discretionary good (lower beta), by gently increasing its debt ratio, and by aggressively using interest rate and foreign currency swaps (lower cost of debt).

[2] Podcast. Listen to this Barry Ritholz podcast with Professor Damodaran; he calls himself "The Kim Kardashian of Valuation". And he discusses lots of topics about finance, valuation, active vs. passive asset management, etc.

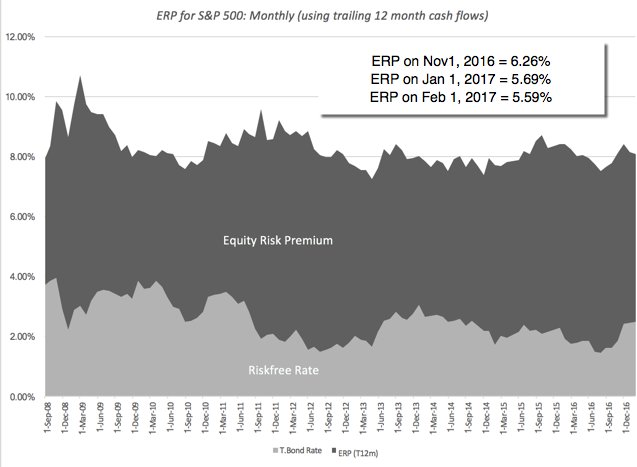

[3] Equity Risk Premium. On his Twitter account, Prof. Damodaran publishes his monthly estimation of the Equity Risk Premium. Instead of relying on historical data, he estimates the expected return on the S&P500 index by projecting cash flows in a two-stage growth version with a Terminal Value. We might take a look at that method this summer in Corporate Finance at EU Business School. The latest estimate: 5.59%.

______________