The (ongoing) Wells Fargo story is just a gold mine from the perspective of a course on Ethics in the Financial World, which I will be teaching in the Fall Semester. I using this post to collect the necessary information. Ideas for debate and conclusions will follow in futher posts.

- General information. A timeline of the Wells Fargo scandal [see].

. On September 8, 2016, the alleged misconduct was revealed when the Consumer Financial Protection Bureau (CFPB), the Los Angeles City Attorney and the Office of the Comptroller of the Currency (OCC) fined the bank $185 million, alleging that more than 2 million bank accounts or credit cards were opened or applied for without customers' knowledge or permission between May 2011 and July 201 [see].

. "In his testimony, Mr. Stumpf gave details about steps the bank has taken to address the problems and to regain customers’ trust. He said that starting in 2013, the bank analyzed questionable behavior related to account openings at its branches and strengthened internal oversight to fix the problems uncovered. The company had already said, following the announcement of the enforcement action, that it was eliminating sales goals for retail bankers for all products. “We should have done more sooner to eliminate unethical conduct and unintended incentives for that conduct to occur,” Mr. Stumpf said. (20 September 2016)" [see; includes VIDEO].

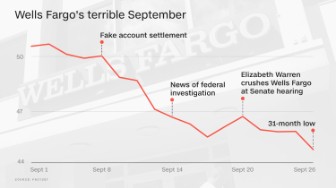

- Reputational risk. Compare the amount of the fines imposed to the loss in market capitalization.

. Bigcharts price quote [see]. Ticker symbol: WFC. Number of shares outstanding: 5.046 billion [see]

- Cost of capital/cost of funding. Credit rating agencies have reacted to the news.

. "Moody's did not signal it would review Wells Fargo's current rating, but said it expects "some immediate damage to Wells Fargo's reputation from this embarrassing episode." However, the Moody's note said Wells Fargo will eventually have a "more durable sales and marketing model" due to expected changes to its sales practices and incentive structures" [see]

. Fitch lowers Wells Fargo's credit outlook to negative: "The outlook revision reflects potential damage to the firm’s franchise and earnings profile following recent regulatory actions regarding improper unauthorized account openings, Fitch said Tuesday in a statement. Fitch reaffirmed the San Francisco-based lender’s rating of AA-/F1+. The ratings company said that even as “customer damages appear limited," the scandal could pressure the bank’s earnings. While WFC emerged from the financial crisis in a much better position than similarly sized peers, Fitch believes this issue creates reputational risk given the issue and allegations are understandable to the general public, in a way that misdeeds at other banks are not, Fitch said, using the lender’s stock symbol [see].

- Clawbacks. Executives have agreed to forfeit part of their pay. Note: it's the Board of Directors, led by its independent members,

. "In seeking to defuse the firestorm over its sham accounts, Wells Fargo & Co.’s board turned to an old, but obscure gambit – getting its top leader to pay up. John Stumpf, the bank's chairman and CEO, will forfeit about $41 million of unvested stock awards and forgo his salary while the company investigates its retail banking sales practices. Carrie Tolstedt, Wells Fargo's former head of community banking, also will forgo her unvested equity stock awards, valued at $19 million, and will not receive retirement benefits worth millions more. Neither Tolstedt nor Stumpf will receive 2016 bonuses. Under the leadership of Stumpf and Tolstedt, hundreds of thousands of sham accounts were opened by employees to meet their sales targets, enraging the customers and triggering ongoing federal investigation. And the bank may not be done with "clawing back" -- as the practice is often called -- the executives' pay. “The independent members of the board will take such other actions as they collectively deem appropriate, which may include further compensation actions,” Stephen Sanger, Wells Fargo’s lead independent director, said Tuesday in a statement" [see].

- Corporate governance. Activist investors push for a shake-up at the top.

. "Banking industry scandals and problems have put a focus on the combined chairman and chief executive role in the past. In 2009, when Bank of America’s Ken Lewis was under fire for his handling of the acquisition of Merrill Lynch, investors voted to separate the roles, in effect stripping him of the chairmanship. Jamie Dimon of JPMorgan Chase defeated proposals to strip him of one of the roles in the wake of the “London whale” trading fiasco. Earlier this year, 17 per cent of Wells shareholders backed Mr Armstrong’s proposal for an independent chairman, the highest level of support since 2013. The activist has presented the proposal for an independent chairman each year since 2012" [see]

- Whistleblowers. Did Wells Fargo fire the whistleblowers?

. "CNN Money has found multiple whistleblowers from Wells Fargo who were willing to go on the record and report that they were fired in retaliation for coming forward to report the massive fraud in which Wells Fargo employees opened up 2,000,000 fake accounts in their customers' names, raiding their real accounts to open them, then racking up fees and penalties, and trashing their customers' credit ratings.CNN also spoke to a former Wells Fargo HR manager who explained how the retaliatory firings worked: employees who blew the whistle would be monitored closely for minor infractions (e.g. being two minutes late for work), then fired "with cause."[see]

__________________

No comments:

Post a Comment